If you’re curious about how your furry friend might affect your homeowners insurance, read on to learn about the potential impacts of different dog breeds. Certain dog breeds can have an impact on your insurance coverage and premiums, and it’s important to understand how insurance companies determine coverage based on these breeds.

Key Takeaways:

- Insurance companies may have breed lists that determine which breeds they will or will not cover.

- Some dog breeds, such as Pit Bulls, Rottweilers, Doberman Pinschers, and German Shepherds, are typically associated with higher insurance premiums.

- Other breeds that may affect homeowners insurance include Siberian Huskies, Akitas, Chows, Great Danes, Presa Canarios, and Alaskan Malamutes.

- Insurance companies may have different approaches to breed exclusions and coverage options, so it’s essential to speak with your insurance agent for clarification.

- Pet liability insurance is a specialized policy that can provide coverage for injuries or damage caused by any kind of dog.

- Some states have passed legislation to prevent insurers from discriminating against specific dog breeds.

Understanding how different dog breeds can affect homeowners insurance is crucial for pet owners. By being aware of the potential impacts, you can make informed decisions and ensure that you have appropriate coverage for your beloved four-legged family member.

Understanding Homeowners Insurance and Dog Breeds

The breed of your dog can affect your homeowners insurance in various ways, including potential increases in insurance rates and coverage restrictions. Insurance companies consider certain dog breeds to be more high-risk due to their history or characteristics. As a result, they may charge higher premiums or limit coverage for homeowners who own these breeds. It’s essential to understand how your dog’s breed can impact your insurance and take necessary steps to ensure you have appropriate coverage.

Some dog breeds are commonly associated with higher insurance premiums due to perceived risk factors. These breeds may include Pit Bulls, Rottweilers, Doberman Pinschers, German Shepherds, Siberian Huskies, Akitas, and wolf-dog hybrids. Insurance companies may view these breeds as more prone to aggressive behavior or potential liability issues. Therefore, if you own one of these breeds, you may expect to pay higher premiums for your homeowners insurance.

Additionally, there are other dog breeds that may affect homeowners insurance in varying degrees. These breeds include Chows, Great Danes, Presa Canarios, and Alaskan Malamutes. While they may not be as commonly associated with higher premiums as the previously mentioned breeds, insurance companies may still consider them to have certain risk factors. It’s important to check with your insurance agent and inquire about any breed-specific restrictions or coverage limitations for these breeds.

| Dog Breeds Associated with Higher Insurance Premiums |

|---|

| Pit Bulls |

| Rottweilers |

| Doberman Pinschers |

| German Shepherds |

| Siberian Huskies |

| Akitas |

| Wolf-dog hybrids |

Some insurance companies have breed-specific exclusions, meaning they will not provide coverage for certain breeds altogether. However, other insurers may offer coverage for any dog breed, focusing more on the individual dog’s behavior and history rather than breed stereotypes. It’s crucial to discuss your dog’s breed with your insurance agent, as they can guide you through the process, provide information on coverage options, and help you find suitable insurance for your specific situation.

It’s worth noting that pet liability insurance is a specialized policy that can provide coverage for injuries or damage caused by any kind of dog, regardless of the breed. This type of insurance can offer additional protection and peace of mind for homeowners who want comprehensive coverage for dog-related incidents. Be sure to inquire about pet liability insurance options when discussing your homeowners insurance with your agent.

Legislation and Breed Discrimination

Some states have taken action against breed discrimination by insurance companies. They have implemented legislation to prevent insurers from discriminating against specific dog breeds when providing homeowners insurance. These laws aim to protect responsible dog owners and ensure fair treatment when securing insurance coverage. If you live in a state with breed-specific legislation, it’s essential to understand your rights and advocate for a fair evaluation of your dog’s behavior and history rather than relying solely on breed stereotypes.

In summary, the breed of your dog can impact your homeowners insurance in various ways, including potential increases in insurance rates and coverage restrictions. Some dog breeds are commonly associated with higher insurance premiums, while others may have breed-specific coverage limitations or exclusions. Speaking with your insurance agent, understanding your options, and considering pet liability insurance can help ensure you have adequate coverage for your specific dog breed. Stay informed about any relevant legislation in your state to advocate for fair treatment and avoid breed discrimination.

Dog Breeds Associated with Higher Insurance Premiums

Insurance companies often consider dog breeds such as Pit Bulls, Rottweilers, Doberman Pinschers, German Shepherds, Siberian Huskies, Akitas, and wolf-dog hybrids as more high-risk, leading to potential increases in insurance premiums. These breeds are often perceived as having a higher likelihood of aggression or causing injuries, which can result in increased liability for homeowners insurance providers. As a result, insurance companies may adjust their coverage and premiums accordingly.

This does not mean that owning these breeds automatically disqualifies you from obtaining homeowners insurance. However, it’s important to be aware that some insurance companies may exclude certain breeds from coverage altogether due to their perceived risk. Others may require additional documentation, such as proof of responsible dog ownership and training, or may charge higher premiums to account for the increased risk associated with these breeds.

It’s worth noting that insurance companies’ breed lists or risk assessments may vary. While some insurers may consider the breeds mentioned above as high-risk, others may have different criteria or even offer coverage for any breed. Therefore, it’s crucial to speak directly with your insurance agent to understand how specific dog breeds can impact your coverage and premiums.

| Dog Breed | Potential Impact on Insurance Premiums |

|---|---|

| Pit Bulls | Increased premiums or breed exclusions |

| Rottweilers | Higher insurance rates or limited coverage |

| Doberman Pinschers | Potential premium increases or restrictions on coverage |

| German Shepherds | Possible higher premiums or limited coverage options |

| Siberian Huskies | Increase in insurance rates or coverage limitations |

| Akitas | Potential impact on insurance premiums or restricted coverage |

| Wolf-dog hybrids | Increased rates or exclusions from coverage |

When considering these dog breeds, it’s essential to assess both the potential impact on your homeowners insurance and the responsibilities that come with owning a breed that may be perceived as higher risk. Proper training, socialization, and responsible pet ownership can help mitigate the perceived risk associated with these breeds and minimize the impact on your insurance coverage and premiums.

Other Dog Breeds That Can Affect Homeowners Insurance

Apart from the previously mentioned breeds, certain other breeds like Chows, Great Danes, Presa Canarios, and Alaskan Malamutes can potentially affect your homeowners insurance coverage and premiums. Insurance companies often view these breeds as having a higher risk potential, which may lead to increased premiums or limitations on coverage.

Chows are known for their protective nature, which can sometimes be perceived as a liability by insurance companies. Great Danes, although gentle giants, have a larger size that may contribute to higher premiums. Presa Canarios, originally bred for guarding livestock, are considered powerful dogs that insurance companies may view as potentially risky. Alaskan Malamutes, known for their strength and independence, may also impact your homeowners insurance rates.

It’s important to note that while these breeds may affect your insurance coverage and premiums, the extent can vary depending on the insurance provider. Consulting with your insurance agent is crucial to understanding the specific impact on homeowners insurance for these breeds. Your agent can provide valuable insights, help you navigate any breed-related restrictions, and ensure you have adequate coverage for your pet.

| Breed | Perceived Risk |

|---|---|

| Chows | Protective nature |

| Great Danes | Large size |

| Presa Canarios | Powerful guarding instincts |

| Alaskan Malamutes | Strength and independence |

Insurance companies often categorize dog breeds based on historical data and breed-specific risk factors. It’s important to have open and honest conversations with your insurance agent to ensure you have the right coverage for your home and pet.

Insurance Companies’ Breed Exclusions and Coverage Options

Insurance companies differ in their stance on dog breeds, with some excluding certain breeds and others providing coverage for all breeds, but it’s vital to understand the potential liabilities and coverage options associated with specific dog breeds. When it comes to obtaining homeowners insurance with specific dog breeds, it’s important to be aware of any breed restrictions or exclusions that may be in place.

Some insurance companies maintain breed lists, which outline the breeds they will or will not cover. Breeds that are typically associated with higher insurance premiums, such as Pit Bulls, Rottweilers, Doberman Pinschers, German Shepherds, Siberian Huskies, Akitas, and wolf-dog hybrids, may face additional scrutiny from insurers. These breeds are often perceived as higher risk due to their size, strength, or historical traits.

Additionally, other dog breeds like Chows, Great Danes, Presa Canarios, and Alaskan Malamutes may also impact homeowners insurance coverage and premiums. It’s advisable to check with your insurance agent to determine the specific policies and coverage options available for these breeds.

| Breed | Exclusion/Higher Premium |

|---|---|

| Pit Bulls | Exclusion/Higher Premium |

| Rottweilers | Exclusion/Higher Premium |

| Doberman Pinschers | Exclusion/Higher Premium |

| German Shepherds | Exclusion/Higher Premium |

| Siberian Huskies | Exclusion/Higher Premium |

| Akitas | Exclusion/Higher Premium |

| Wolf-Dog Hybrids | Exclusion/Higher Premium |

It’s worth noting that some insurance companies do not have breed restrictions or exclusions. They may offer coverage and determine premiums based on other factors such as the dog’s individual behavior and training. When exploring coverage options, it’s crucial to compare quotes from different insurers to find a policy that suits your needs while accommodating your specific dog breed.

Understanding the impact of dog breeds on homeowners insurance is essential for responsible pet ownership. By consulting your insurance agent and reviewing policies, you can ensure that you have the right coverage in place to protect yourself, your home, and your beloved four-legged family member.

Pet Liability Insurance and Its Importance

Pet liability insurance, a specialized policy designed to cover injuries or damage caused by dogs, regardless of breed, can offer additional protection and peace of mind for homeowners. With the potential risks associated with dog ownership, having this insurance coverage can help mitigate financial and legal liabilities that may arise from dog-related incidents.

Unlike homeowners insurance, which may have breed restrictions or exclusions, pet liability insurance focuses on the behavior and actions of individual dogs rather than specific breeds. This means that regardless of whether you own a Pit Bull or a Chihuahua, you can obtain coverage for injuries or damage caused by your dog. It provides a safety net that can protect you in case your dog bites someone or causes property damage.

It’s important to note that pet liability insurance typically covers dog-related incidents that occur both on your property and off, such as if your dog were to bite someone while you’re out on a walk or at a public park. This coverage extends beyond the confines of your homeowners insurance policy, which may have limitations on liability coverage for dog-related incidents.

Additional Coverage and Peace of Mind

In addition to covering injuries or damage caused by your dog, pet liability insurance often includes additional benefits that can offer peace of mind. These benefits may include coverage for legal expenses, such as hiring an attorney if you are sued, as well as medical expenses for the injured party. Some policies also provide coverage for property damage caused by your dog, including damage to the belongings of others or damage to rental properties if you are a tenant.

Before purchasing pet liability insurance, it’s important to carefully review the terms and conditions of the policy, including any coverage limits and exclusions. Every insurance policy is different, so it’s crucial to understand what is covered and what is not. Consulting with an insurance agent who specializes in pet liability insurance can help ensure that you select the right policy for your needs and budget.

Remember, accidents can happen, regardless of the breed of your dog. Pet liability insurance offers homeowners the peace of mind and financial protection they need in case of dog-related incidents. By obtaining this specialized policy, you can protect yourself, your dog, and your home from potential legal and financial consequences.

Legislation and Breed Discrimination

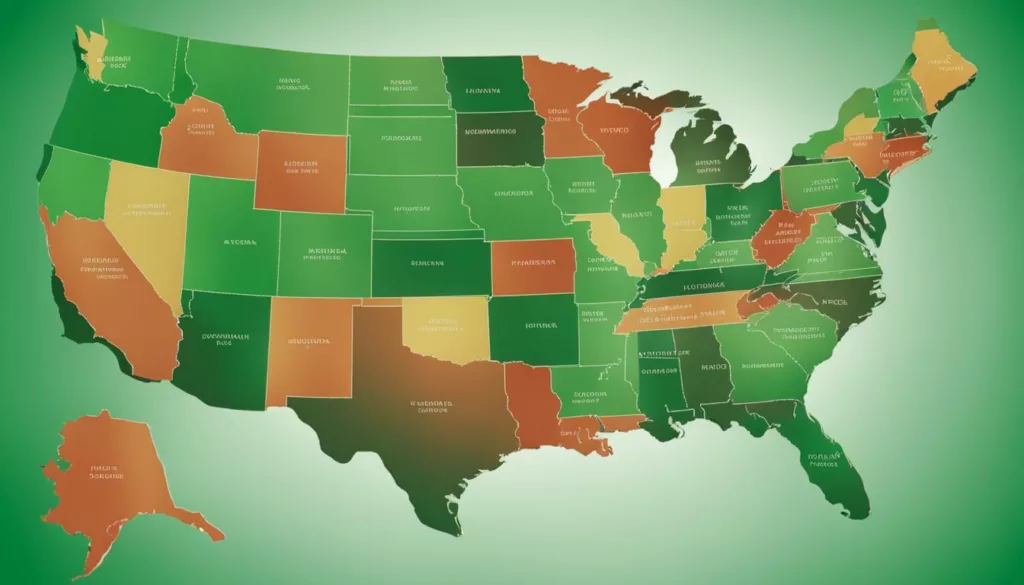

Several states have passed legislation to ban insurance companies from discriminating against certain dog breeds, seeking to ensure fair treatment for all homeowners. These laws aim to prevent insurance companies from denying coverage or charging higher premiums based solely on the breed of a homeowner’s dog. By enacting these measures, states strive to create a more inclusive and equitable insurance environment for dog owners.

One such state is California, which passed a law prohibiting insurance companies from refusing to issue or renew a homeowners insurance policy solely based on the breed of a dog. The law recognizes that responsible dog ownership and behavior are more important indicators of risk than breed alone. Other states, such as Michigan and Pennsylvania, have enacted similar legislation to protect homeowners from breed-based discrimination.

These laws not only benefit homeowners with specific dog breeds but also promote a more accurate assessment of risk by insurance companies. By focusing on individual dog behavior, training, and responsible ownership, insurers can better evaluate the potential risks associated with a particular dog, regardless of its breed. This approach allows insurance companies to provide coverage that is fair and reflective of the actual risk posed by the dog.

Key Points:

- Several states have passed legislation to ban insurance companies from discriminating against certain dog breeds.

- These laws aim to ensure fair treatment for all homeowners and prevent denial of coverage or higher premiums based solely on breed.

- States like California, Michigan, and Pennsylvania have enacted laws recognizing responsible ownership and behavior as more important indicators of risk than breed alone.

- By focusing on individual dog behavior and responsible ownership, insurers can accurately assess the potential risks associated with any dog breed.

| State | Legislation |

|---|---|

| California | Prohibits insurance companies from denying coverage or charging higher premiums based on breed |

| Michigan | Bans breed-based discrimination in homeowners insurance |

| Pennsylvania | Enacts laws to protect homeowners from breed-related discrimination |

Consulting Your Insurance Agent and Reviewing Policies

When considering adding a new dog breed to your family, it’s essential to have a conversation with your insurance agent to understand how it may affect your homeowners insurance coverage and premiums. Insurance companies have varying approaches when it comes to specific dog breeds, so it’s important to be informed and prepared. Speaking with your insurance agent will provide clarity on how your chosen breed could impact your policy and what steps you can take to ensure adequate coverage.

Your insurance agent will be able to inform you if your chosen dog breed is on their list of restricted breeds or if they have any specific policies regarding coverage for certain breeds. Some insurance companies exclude certain breeds altogether, while others may charge higher premiums based on risk assessment. By understanding these factors, you can make an informed decision and potentially avoid any surprises when it comes to your homeowners insurance.

During your conversation with your insurance agent, it’s also crucial to review your existing policy to determine if any changes need to be made. You should discuss the liability coverage in relation to your dog and confirm whether it is sufficient. Depending on the breed, insurers may require additional liability coverage or offer specialized policies such as pet liability insurance to ensure comprehensive protection. It’s best to be proactive in understanding your policy and making any necessary adjustments to avoid coverage gaps or unexpected costs down the line.

Remember, each insurance company has its own guidelines and rules when it comes to dog breeds and homeowners insurance. By consulting your insurance agent and reviewing your policy thoroughly, you can make informed decisions to protect both your home and your furry family member.

Conclusion

Understanding the relationship between dog breeds and homeowners insurance can help you make informed decisions and ensure that you have the appropriate coverage for your furry friend.

When it comes to homeowners insurance, certain dog breeds can have an impact on your coverage and premiums. Insurance companies often have breed lists that determine which breeds they will cover and which ones they may exclude. Breeds such as Pit Bulls, Rottweilers, Doberman Pinschers, German Shepherds, Siberian Huskies, Akitas, and wolf-dog hybrids are typically associated with higher insurance premiums. Other breeds, including Chows, Great Danes, Presa Canarios, and Alaskan Malamutes, may also affect your homeowners insurance.

It is important to consult with your insurance agent before adding a new dog breed to your family. They can provide valuable insight into how specific breeds may impact your coverage and premiums. Some insurance companies may exclude certain breeds altogether, while others may offer coverage for any breed.

Additionally, pet liability insurance is a specialized policy that can provide coverage for injuries or damage caused by any kind of dog, regardless of breed. This type of insurance can give you added peace of mind and protect you financially in case of any incidents involving your furry friend.

In recent years, some states have taken action against breed discrimination by insurance companies. These states have implemented legislation to prevent insurers from denying coverage or charging higher premiums based on specific dog breeds. If you live in one of these states, it’s important to be aware of your rights and how it may impact your homeowners insurance policy.

In conclusion, understanding the impact of dog breeds on homeowners insurance coverage and premiums is crucial for responsible pet owners. By consulting with your insurance agent, exploring pet liability insurance options, and being aware of any breed-specific legislation in your state, you can ensure that you have the appropriate coverage to protect your home and your beloved canine companion.

FAQ

Can certain dog breeds affect homeowners insurance coverage and premiums?

Yes, certain dog breeds can impact homeowners insurance coverage and premiums. Insurance companies may have breed lists that determine which breeds they will or will not cover, and some breeds may be associated with higher premiums.

Which dog breeds are typically associated with higher insurance premiums?

Dog breeds typically associated with higher insurance premiums include Pit Bulls, Rottweilers, Doberman Pinschers, German Shepherds, Siberian Huskies, Akitas, and wolf-dog hybrids.

Are there other dog breeds that may affect homeowners insurance?

Yes, other breeds that may affect homeowners insurance include Chows, Great Danes, Presa Canarios, and Alaskan Malamutes.

What do insurance companies do if a specific breed of dog is excluded from coverage?

Some insurance companies may exclude certain breeds from coverage, while others may offer coverage for any breed. It is important to speak with your insurance agent to understand the impact a specific breed may have on your coverage and premiums.

Can I obtain homeowners insurance with a specific dog breed?

Insurance companies have varying policies regarding dog breeds. Some may offer coverage for specific breeds, while others may have exclusions. It’s crucial to consult with your insurance agent to explore your options and find coverage that suits your needs.

Is there a specialized insurance policy for dog-related incidents?

Yes, pet liability insurance is a specialized policy that can provide coverage for injuries or damage caused by any kind of dog, regardless of the breed.

Have any states passed legislation against breed discrimination by insurers?

Yes, some states have passed legislation to ban insurers from discriminating against certain dog breeds. These laws aim to prevent breed-based discrimination in homeowners insurance policies.

Why is it important to speak with my insurance agent about specific dog breeds?

It is crucial to speak with your insurance agent before adding a new dog breed to your family. They can help you understand the impact the breed may have on your homeowners insurance coverage and premiums, ensuring you have the right protection for your home and your furry family member.

Hi, I’m John and I love dogs. Ever since I was a kid, I always wanted to have a furry friend by my side. I grew up with a golden retriever named Max, who taught me a lot about loyalty, friendship, and fun. He was my best buddy for 12 years, and I miss him every day.